Learn Forex: A Clear, Beginner‑Friendly Guide to Trading With Confidence - Everything you need to understand the Forex market, build a strong foundation, and trade with intention — not guesswork.

What Is Forex Trading?

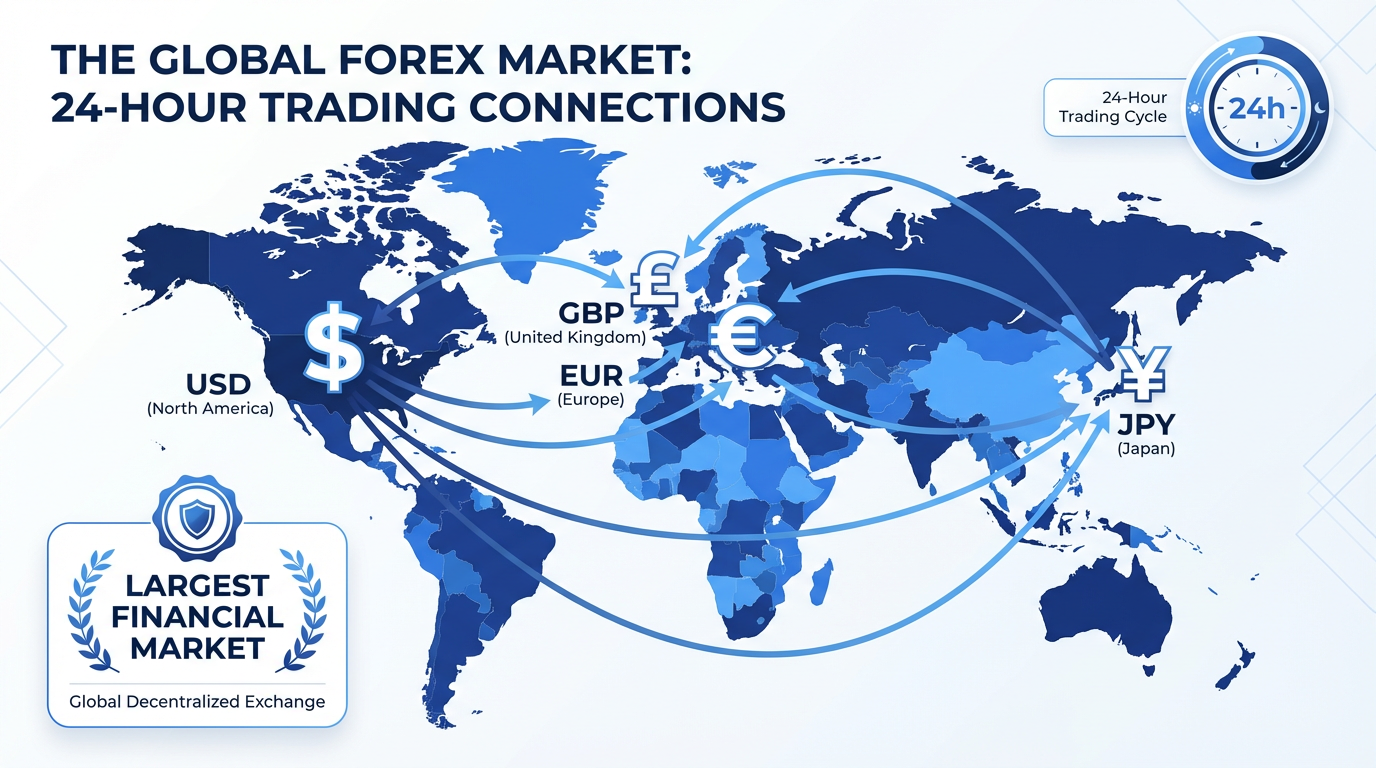

Forex trading is the global exchange of currencies — a 24‑hour market where traders buy and sell currency pairs to profit from price movements. It’s the largest financial market in the world, and when approached with structure and discipline, it becomes one of the most accessible.

In this guide, you’ll learn:

- how the market works

- what moves currency prices

- how to manage risk

- how to build a simple, repeatable trading plan

How the Forex Market Works

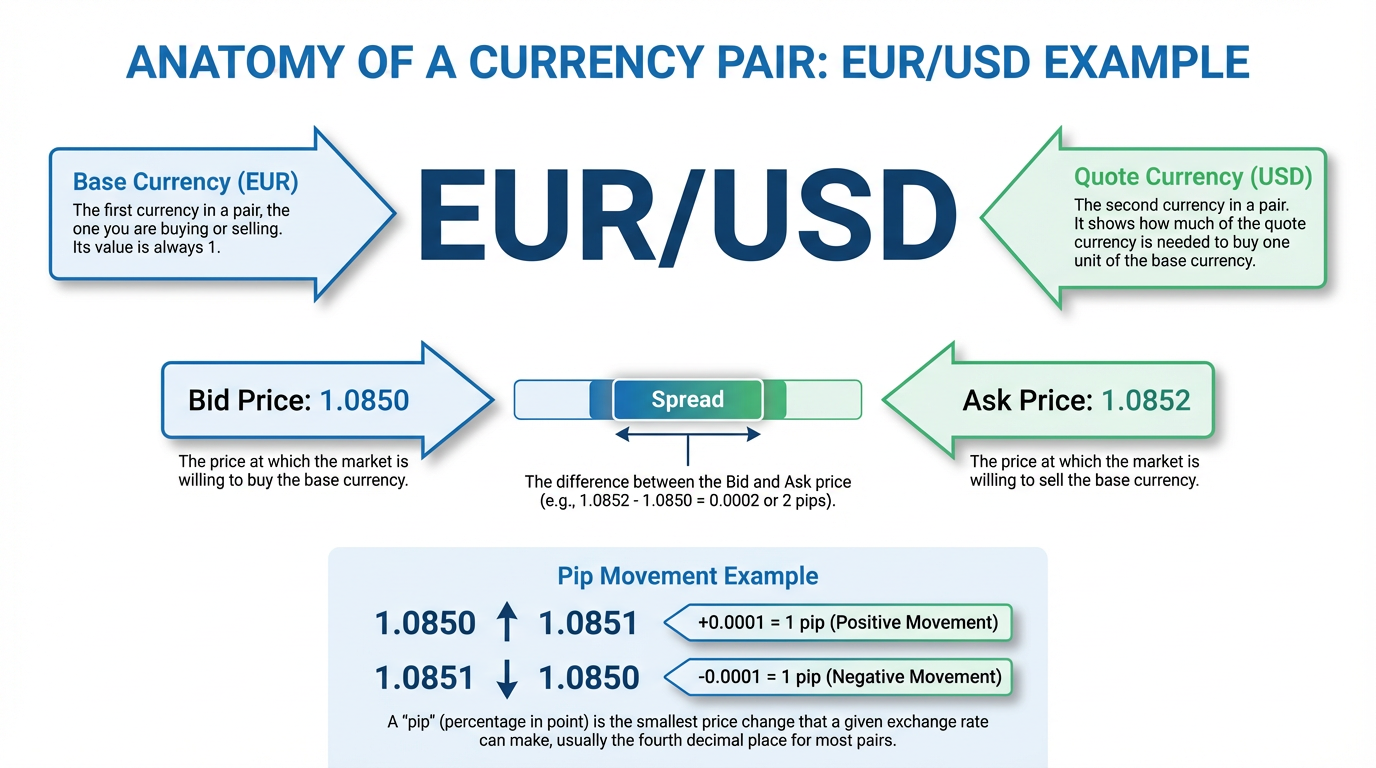

Forex is traded in currency pairs (EUR/USD, GBP/JPY, etc.). Each pair represents the value of one currency relative to another.

Key concepts:

- Base currency vs. quote currency

- Pips and pip value

- Lots and position sizing

- Bid/ask prices and spreads

- Market sessions (London, New York, Asian)

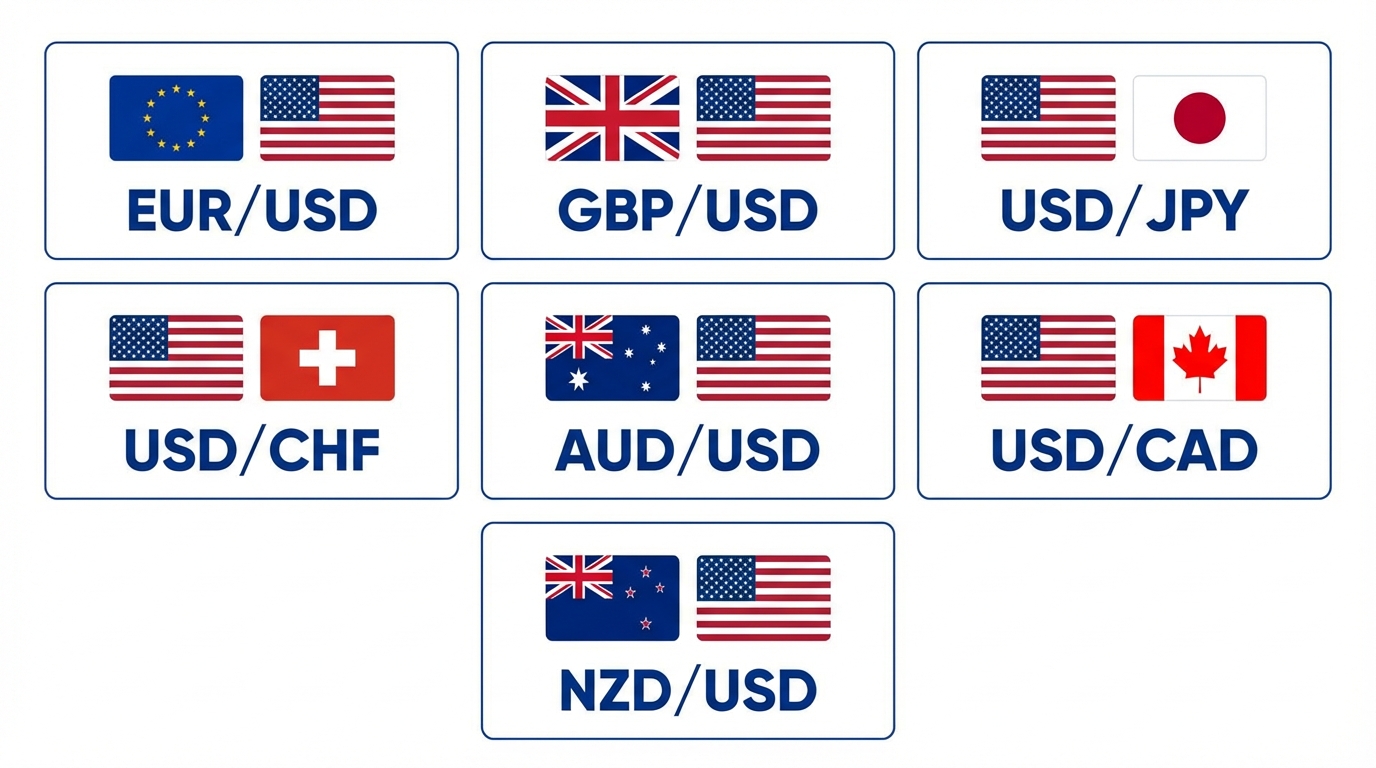

The Major Currency Pairs

There are dozens of pairs, but most traders focus on the majors:

- EUR/USD

- GBP/USD

- USD/JPY

- USD/CHF

- AUD/USD

- USD/CAD

- NZD/USD

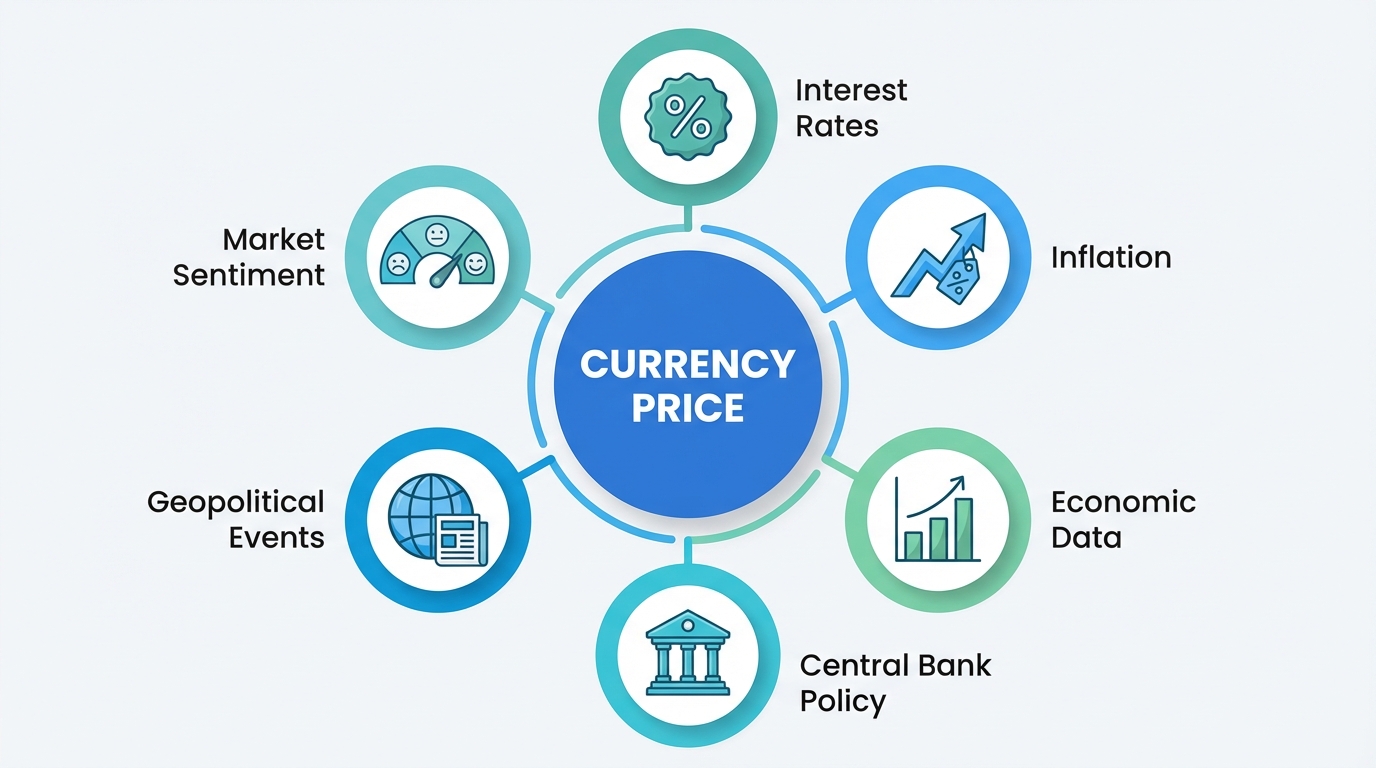

What Moves the Forex Market?

Forex prices move because of:

- interest rates

- inflation

- economic data

- central bank policy

- geopolitical events

- market sentiment

This is where Fundamental Analysis connects to your trading decisions.

Internal Link: → Learn more in our Fundamental Analysis Guide

Technical Analysis Basics

Technical analysis helps you read price action and identify high‑probability setups.

Core tools include:

- support and resistance

- trendlines

- chart patterns

- candlestick formations

- indicators (RSI, moving averages, MACD)

Internal Link: → Explore our Technical Analysis Guide

Risk Management (Your #1 Skill)

This is where traders win or lose long‑term.

Key principles:

protect capital first, grow second

never risk more than 1–2% per trade

always use a stop‑loss

size positions based on account size

avoid over‑leveraging

This section reinforces discipline and prevents beginner blow‑ups.

Trading Psychology

Your mindset determines your consistency.

You’ll learn how to:

- avoid emotional trading

- stay patient

- follow your plan

- manage fear and greed

- build confidence through repetition

Internal Link: → Visit our Trading Psychology Guide

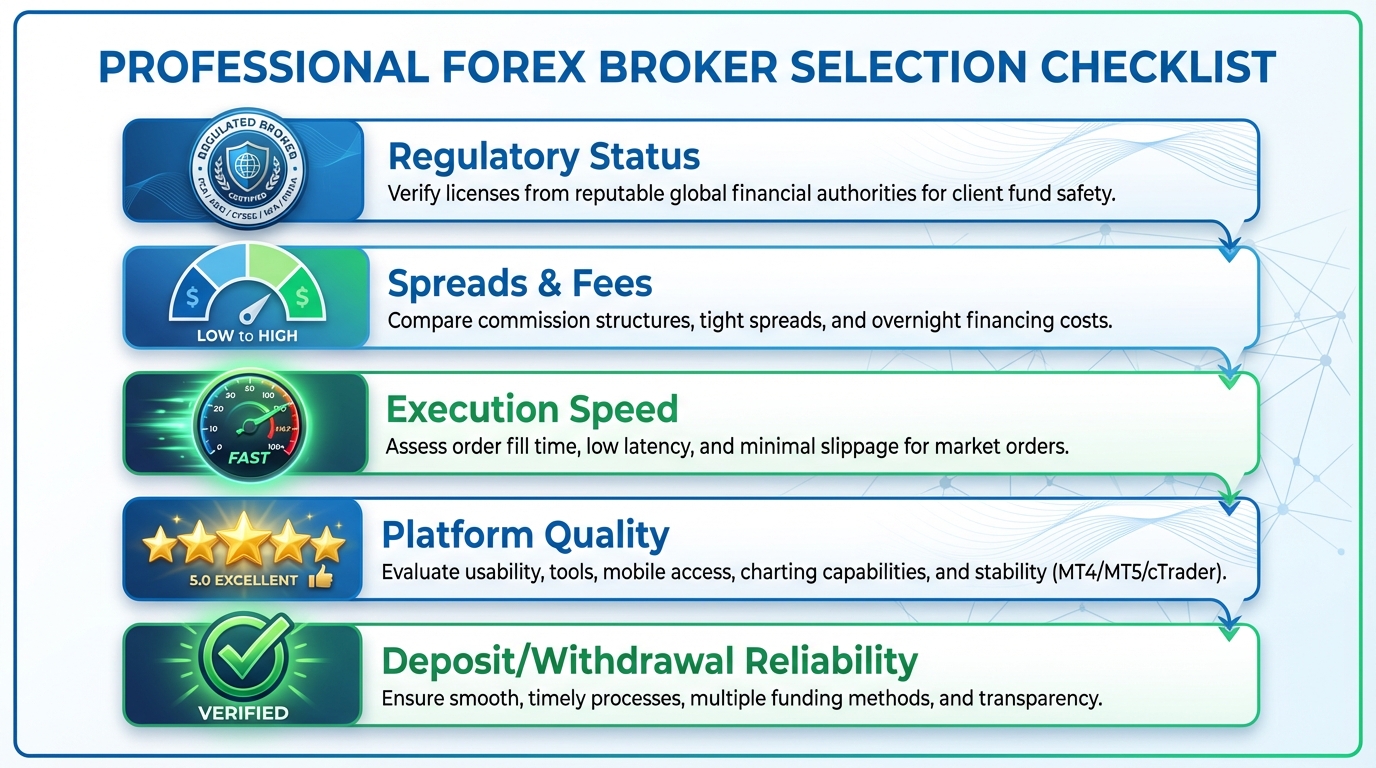

Choosing a Forex Broker

A safe, regulated broker protects your capital and ensures fair execution.

What to look for:

- regulation

- spreads and fees

- execution speed

- platform quality

- deposit/withdrawal reliability

Internal Link: → Compare brokers in our Broker Reviews Hub

Tools You’ll Use as a Trader

To trade efficiently, you’ll rely on:

- position size calculators

- economic calendars

- charting platforms

- templates and checklists

- journaling tools

Internal Link: → Explore our Forex Tools Library

Build Your First Trading Plan

A simple, beginner‑friendly plan includes:

- your trading style (day, swing, position)

- your strategy

- your risk rules

- your entry/exit criteria

- your journaling process

This section helps beginners move from theory to action.

Next Steps (CTA)

You now understand the core foundations of Forex trading. Your next step is to explore each topic in more depth and start building your own structured approach.

CTA Buttons: